Construction of a hundred “positive energy” Elithis residential towers in Europe, financed by a €2 billion investment program from Catella Residential IM

the 27/11/2019

A €2 billion investment program dedicated to the construction of 100 “positive energy” residential towers in various European cities by 2030 has been launched by Berlin-based Catella Residential Investment Management (CRIM) in partnership with Dijon-based engineering company Elithis.

These towers will offer apartments at reasonable rents and will sell their excess electricity to the national grids.

CRIM and Elithis will begin development of their first three residential towers in Dijon, St. Etienne and Montevrain in 2020, with plans to launch three additional projects in France later that year. Projects in other European cities will follow in 2021.

Xavier Jongen, Chairman and CEO of CRIM, states: “Europe’s major cities are facing a crisis related to the lack of affordable housing, especially for young people who flock to large urban centers to study and work, knowing that the residential supply is far from meeting the considerable demand. We believe that the partnership between Catella and Elithis offers a model for a potential solution to this crisis, which is fragmenting the social fabric of our cities, while at the same time addressing the other great challenge of our time, namely climate change. This can only be achieved by capitalizing on the financial strength of institutional investors who are becoming aware of the enormous untapped investment potential of European housing markets. Not only do these investments offer stable, long-term, low-risk rental returns, but they also allow pension funds, insurers, and others to meet the growing requirement to prioritize investments with positive social and environmental impact.”

Elithis is a world leader in the design and development of positive energy buildings, while Catella manages the largest cross-border residential real estate investment platform in Europe, with total assets of nearly €4 billion in nine countries. By joining forces, the two partners have been able to offer unprecedented European residential investment opportunities, both in terms of scale and in terms of their sustainability and social responsibility objectives in this sector.

CRIM has initially committed to invest in three residential towers on behalf of its specialized residential funds. Some 36 development sites have been identified in France and the two partners aim to complete a total of 50 projects in key urban centers across the country. The first project outside of France will be launched in 2021, as part of a strategy to develop approximately 50 additional residential towers throughout Europe over the next decade.

Thierry Bièvre, President of Elithis, said: “For over 10 years, we have been designing and developing positive energy buildings. Our positive energy office tower, delivered in Dijon in 2009, was the first of its kind in the world and still exceeds regulatory requirements and industry standard certifications. After achieving this milestone, we were able to improve our design model and deliver the world’s first energy-positive residential tower in 2018: the Elithis Danube Tower in Strasbourg. Our landmark agreement with Catella will help us broaden our base and further solidify our building expertise and ability to develop affordable residential buildings that incorporate a virtuous energy and carbon emissions cycle.”

Under the terms of the partnership, we will ensure that each new tower surpasses the last by incorporating “continuous improvement” practices into the development process. The towers will also be constructed in such a way that they can be easily converted to non-residential uses, if necessary. Despite all these durable features, the construction costs are not higher than for a regular residential tower.

The technology used in the buildings (photovoltaic panels and bioclimatic design to protect the environment and natural resources) makes the energy positive from the start. Positive energy towers are buildings that generate more energy than the tenants consume, and each tower developed will reward individual sustainability efforts with clever applications of artificial intelligence. Not only will residents have the ability to totally or partially erase their energy bill, which will save an average French family about 1,600 euros per year, but they will also benefit from the lower operating costs of the tower thanks to the least expensive technological choices in terms of maintenance.

À About Catella Residential Investment Management GmbH (CRIM)

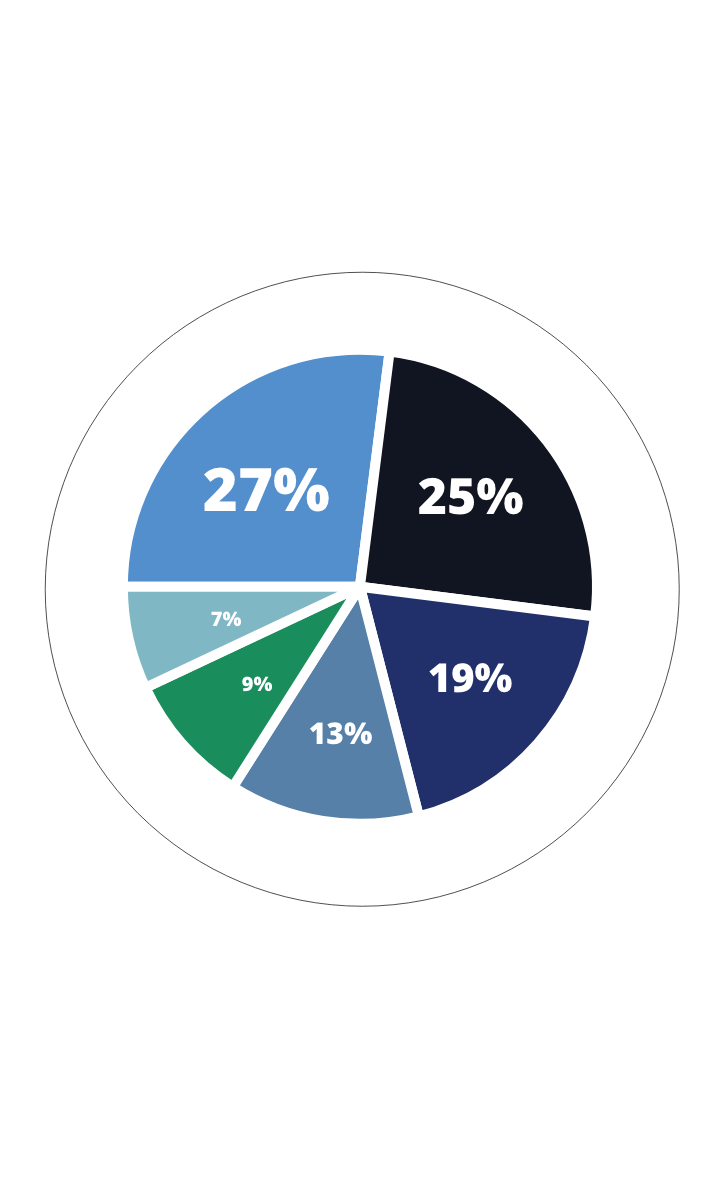

Catella Residential Investment Management (CRIM) launched its first €1 billion residential real estate fund in 2007, which has generated an average net investor return of 8.2% per year since its launch through the end of the third quarter of 2019. CRIM also launched the first European fund specialized in student housing in 2013.

CRIM is a subsidiary of the Swedish company Catella AB in Stockholm and its residential real estate business includes consulting services in portfolio management, buying and selling and asset management. The company manages and advises several funds and mandates, with assets under management of nearly €4 billion in nine European countries.

One Hundred Elithis ‘Energy-Positive’ Resi Towers to Rise over European Skylines from €2 billion Catella Residential IM Investment Pipeline

A €2 billion investment programme to build 100 ‘energy-positive’ residential towers across Europe by 2030 has been launched by Berlin-based Catella Residential Investment Management (CRIM) in partnership with Dijon-based building engineering company Elithis. The towers will offer apartments at affordable rents and supply surplus power back to national grids.

CRIM and Elithis will start developing their first three residential towers in Dijon, St Etienne and Montevrain in France in 2020, and plan to launch three additional schemes in the French market later next year. Other European cities will follow in 2021. Energy-positive towers are buildings that generate more energy than tenants consume.

Xavier Jongen, Managing Director at CRIM, said: “Major European cities are facing an affordability housing crisis, particularly for younger people flocking to the big urban centers for education and work, because residential supply is nowhere close to meeting the huge demand. We believe that Catella’s partnership with Elithis offers a blueprint for one potential solution to this crisis, which is fragmenting the social fabric of our cities, while also addressing the other great challenge of our times in global climate change. This can only be achieved by harnessing the financial firepower of institutional investors who are now realising the great untapped investment potential of European residential markets. Not only do these investments offer stable, long-term and low-risk rental income-based returns, they also allow pension funds, insurers and others to meet their increasing obligations to target investments that make a positive social and environmental impact.”

Elithis is a world leader in the design and development of energy-positive buildings, while Catella manages the largest cross-border residential real estate investment platform in Europe, with total assets of close to €4.0 billion over nine countries. By combining forces, the two partners have been able to offer a European residential investment proposition that is unprecedented in its scale, as well as its ambitions in sustainability and social responsibility, in the sector.

Thierry Bievre, CEO Elithis, said: “For more than 10 years, we have been conceiving, designing and developing energy-positive buildings. Our energy-positive office tower delivered in Dijon in 2009 was the first of this type in the world and still outperforms industry regulatory requirements and standard certifications. After achieving that milestone, we were able to enhance our conceptual model and deliver the world’s first energy-positive residential tower in 2018: the Elithis Danube Tower in Strasbourg. Our landmark agreement with Catella will help us broaden our base, and further consolidate our construction expertise and ability to develop affordable residential buildings incorporating a virtuous energy and carbon emission cycle.”

CRIM has made an initial equity commitment for investment into three residential towers on behalf of its specialist residential funds. Some 36 sites have been identified in France for development and the partners are aiming to deliver a total of 50 projects in major urban centers throughout the country. The first projects outside France will be launched in 2021 as part of a strategy to develop a further 50 energy-positive residential towers across European markets over the next decade.

Under the terms of the partnership, every new tower that is built will seek to be better than the previous one, by embedding ‘continuous improvement’ practices into the development process. The towers will also be built in such a way that they can easily be converted for other functions than residential use, should this be necessary. Despite all the sustainable features, the construction costs are no higher than for a regular residential tower.

The technology employed in the buildings (photovoltaic panels and a bioclimatic design which aims to protect the environment and natural resources) makes them energy positive from the outset. Each tower developed by the partners will reward individual efforts in sustainability through smart artificial intelligence applications. Not only will the inhabitants have the ability to totally or partially eliminate their energy bills, which will allow an average French family to save around €1,600 per year, but they will also benefit from the lower operating costs of the tower thanks to the least expensive technological choices in terms of maintenance.

About Catella Residential Investment Management GmbH (CRIM)

Catella Residential Investment Management (CRIM) initiated its first one billion-euro European residential fund in 2007 and this has produced average net returns for investors of 8.2% a year since launch until end-Q3 2019. CRIM launched Catella’s first specialized European Student Housing Fund in 2013.

CRIM is a subsidiary of Swedish Catella AB in Stockholm and its residential real estate business includes advisory services in portfolio management, acquisition and sales, and asset management. The company manages and advises several funds and mandates with assets under management of close to €4 billion across nine countries in Europe.